Tax Services For Individuals

Navigate the tax season with ease! Experience hassle-free tax preparation solutions with our expert tax services for individuals. From maximizing your refund to ensuring compliance, we handle it all with unmatched expertise. Start your journey to better financial health today

Award Winning Tax Services for Individuals

Experience unparalleled excellence with our award-winning tax services for individuals. Our tax preparer ensures your every tax return is filed with precision. We take pride in our ability to demystify complex tax laws, making them understandable and manageable for you. Whether you’re dealing with simple wage-based returns or more complex situations involving investments, real estate, or freelance income, our services are designed to navigate the intricacies of each scenario effectively. Trust us to safeguard your financial health and keep you compliant, all while optimizing your financial outcomes. With us, tax season becomes less daunting and more rewarding. Join the ranks of our satisfied clients and let our expertise lead the way to your financial peace of mind.

- Ensure every tax return is accurate and compliant.

- Offers personalized support throughout the tax preparation process and beyond.

- Tailors service to maximize deductions and enhance refunds.

- Provides strategic planning to reduce future tax liabilities.

- Ensures timely filing to avoid penalties and late fees

Personalized Individual Tax Preparation Solutions Near You

Seeking tailored tax assistance in New York and New Jersey? Our personalized individual tax preparation solutions are perfect for high-income individuals. We ensure you breeze through complex personal income tax regulations, including Schedule C filings and 1099-NEC forms. Let our tax experts maximize your savings and reduce your stress.

Accurate Tax Deductions

Get accurate tax deductions with our expert personal income tax assistance. We’re all about finding every deduction to boost your savings and cut down on what you owe. Our approach not only guarantees accuracy but also offers potential tax relief opportunities to make sure you’re getting the best deal. Moreover, as your personal tax advisor help you navigate the complexities of tax laws effectively. Let us take the hassle out of tax season and put more money back in your pocket.

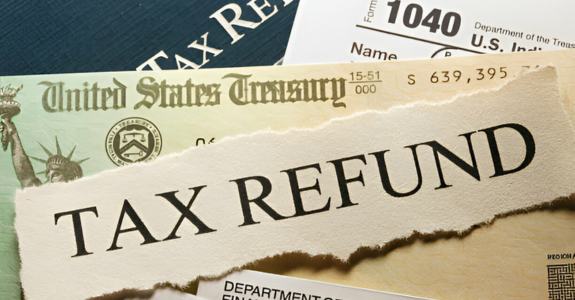

Process Faster Refunds

Speed up your refund process with our tax preparation services just for individuals. We blend precise accounting and bookkeeping to keep your financial records flawless and your tax filings are error-free. By optimizing your tax documents and submissions, we not only enhance accuracy but also speed up the refund process. Let us manage the complexities of your tax preparation, so you can enjoy faster, stress-free refunds every tax season. Streamline your tax refund by filing Form 1040 early to ensure a quicker, more efficient process annually.

Tax Compliance Audits

Get personal tax compliance audits without a hitch for your income tax filings with our expert help. We’re here to tackle your tax problems and find the best solutions tailored to your unique situation. Making sure everything is spot-on for the IRS guidelines. Our proactive support keeps your records tidy and audit-proof. With us guiding you, you can relax knowing we’ve got every detail covered. Let’s handle your tax affairs together, keeping things smooth and stress-free.

Struggling with filling out 1040 form?

Let us prepare your income tax returns accurately and ensure every deduction is captured.

Our Stress-Free Approach to Form 1040

Eliminate the stress with our easy Form 1040 approach. Expert guidance, quick processing, and peace of mind, all in one package.

1. One-on-One Consultations

Start with a personal consultation to understand your financial situation and tailor our services to your tax preparation needs.

2. Tackling Your Tax Paperwork

We take care of all your tax documents and verify each detail for accuracy before submission.

3. Submit Your Tax Return

As soon as your tax forms are prepared, we submit your forms 1040 before the deadline to avoid penalties.

What Our Clients Says

We Cater all Types of Individual Tax Forms

Navigating tax season can be complex, but with our expertise, it doesn’t have to be. We specialize in a comprehensive range of individual tax forms in USA, to ensure every aspect of your financial life is accurately reported and compliant:

1. Form 1040 Variants

From basic to more complex filings, we handle all variants of Form 1040, ensuring accurate reporting for different income types and deductions, including considerations for seniors and non-residents.

2. Wage and Investment Income Forms

We manage all your W-2 and 1099 forms, capturing details of wages, dividends, interest, and miscellaneous income to maintain precise income tracking.

3. Health Coverage Forms

Compliance is key with health insurance mandates. We adeptly manage Forms 1095-A, 1095-B, and 1095-C to verify coverage whether it’s through the Marketplace or provided by your employer.

4. Self-Employment and Business Forms

For freelancers and sole proprietors, we meticulously prepare Schedule C for business income and expenses, and calculate self-employment tax with Schedule SE.

5. Deductions and Gains Forms

Maximize your deductions with Schedule A and accurately report your capital gains and losses with Schedule D, for optimizing your tax savings.

Simplify Tax Season with Our Personal Tax Advisor

Experience a hassle-free tax season with our dedicated personal tax advisors in New York. Our experts specialize in simplifying complex tax scenarios, including navigating payroll tax intricacies and managing sales tax compliance. Whether you’re juggling multiple income sources or dealing with specific local tax obligations, our tax service for individuals ensures that every detail is meticulously handled.

By partnering with us, you’ll benefit from personalized guidance tailored to your unique financial situation, helping you optimize your returns and reduce liabilities. Let us take the stress out of tax season, so you can focus on what matters most.

Our Additional Services

Your Ultimate Choice for Top Tax Services For Individuals

At Tax & Accounting Hub, we’re your go-to for stellar tax services for individuals across the USA. From seamless business tax preparation to foremost outsourced bookkeeping, we’ve got you covered. Our international tax accountant expertly managed QuickBooks solutions, making sure your finances are neat and tidy prior to calculating personal income tax liability. Whether you’re running a small business, freelancing, or just need a hand with your taxes, we’re here to make everything as easy as pie. Choose us for reliability, precision, and a personalized approach to your tax and accounting needs.

Needs Professional Accounting Services? Contact Us

Our team of seasoned accounting professionals can help you navigate the maze of deductions, credits, and paperwork and minimize your stress.

Contact us today for a free consultation.

FAQ

Frequently Asked Questions

Yes, personal income tax services identify all eligible deductions and credits, ensuring you get the maximum refund possible. They leverage their expertise to optimize your tax situation, making sure you don’t miss out on any savings.

Absolutely, individual tax professionals provide valuable insights and strategies for future tax planning. They help you make informed decisions throughout the year, reducing your tax liability and ensuring you’re prepared for upcoming tax obligations.

Yes, tax services are especially beneficial for self-employed individuals and freelancers. They handle the complexities of self-employment taxes, ensure accurate reporting, and help you take advantage of specific deductions and credits to minimize your tax burden.

Using a tax preparer can save you time, reduce stress, and ensure accuracy. Tax preparers are knowledgeable about current tax laws and can help you avoid mistakes, potentially saving you money and ensuring you get the best possible outcome.

Yes, income tax preparation services handle both federal and state tax returns. They ensure all forms are accurately completed and filed on time, helping you meet all your tax obligations efficiently and effectively.